Crypto: Understanding the Basics and Its Impact on the Financial World

Crypto, short for cryptocurrency, has emerged as a powerful force in the global financial system. Since the introduction of Bitcoin in 2009, cryptocurrencies have grown in popularity, offering decentralized alternatives to traditional banking and currency systems. Crypto enables faster, cheaper transactions, enhances privacy, and opens up new opportunities in decentralized finance (DeFi) and digital assets. In this guide, we will explore what crypto is, how it works, and its impact on the world.

What Is Cryptos?

Crypto refers to digital or virtual currencies that use cryptography for security. Unlike traditional fiat currencies controlled by central banks, crypto operates on decentralized networks, typically using blockchain technology. This decentralized nature allows for peer-to-peer transactions without the need for intermediaries such as banks or payment processors.

The first and most well-known cryptocurrency, Bitcoin, created a blueprint for other digital currencies. Over the years, thousands of cryptocurrencies have been introduced, each with unique features and purposes. However, they all share the common goal of enabling secure, transparent, and decentralized financial transactions.

How Does Cryptos Work?

Crypto transactions rely on blockchain technology, a decentralized ledger that records transactions across a network of computers (also known as nodes). Here’s how the system functions:

- Transaction Initiation: A user sends cryptocurrency (such as Bitcoin or Ethereum) to another user by creating a transaction request. This request includes details like the recipient’s wallet address and the amount being sent.

- Validation: The transaction is broadcast to the network, where miners or validators confirm its legitimacy. These participants use consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS) to validate the transaction.

- Block Creation: Once validated, the transaction is added to a “block” along with other confirmed transactions. This block is then added to the blockchain, creating a permanent and immutable record of the transaction.

- Finalization: After the transaction is recorded in the blockchain, the recipient receives the cryptocurrency. This process is often much faster and cheaper than traditional banking methods, especially for cross-border payments.

Popular Cryptocurrencies

Here are some of the most well-known cryptocurrencies:

- Bitcoin (BTC): As the original cryptocurrency, Bitcoin is widely used as a store of value and a medium of exchange. It remains the most valuable and recognizable crypto asset.

- Ethereum (ETH): Ethereum introduced smart contracts, enabling decentralized applications (dApps) and automated financial transactions. Its blockchain is the foundation for many other crypto innovations.

- Ripple (XRP): Ripple aims to facilitate fast and low-cost cross-border payments, primarily for banks and financial institutions.

- Litecoin (LTC): Known for faster transaction times and lower fees than Bitcoin, Litecoin serves as a practical alternative for everyday transactions.

- Stablecoins: Cryptocurrencies like Tether (USDT) and USD Coin (USDC) are pegged to the value of fiat currencies, providing a stable store of value without the volatility of traditional cryptocurrencies.

Key Features of Cryptos

Crypto offers several advantages over traditional financial systems:

- Decentralization: Unlike traditional currencies, crypto is not controlled by a central authority, allowing users to manage their own funds without intermediaries.

- Lower Transaction Fees: Crypto transactions typically involve lower fees than those charged by banks or payment processors, especially for cross-border transfers.

- Security and Privacy: Cryptocurrencies use advanced encryption techniques, making them secure and resistant to fraud. Additionally, crypto transactions can offer a higher degree of privacy compared to traditional banking.

- Global Accessibility: Anyone with an internet connection can use crypto, providing financial services to people without access to traditional banks.

- Programmable Money: With the advent of smart contracts, cryptocurrencies like Ethereum can be programmed to execute specific actions automatically, enabling decentralized finance (DeFi) applications and tokenized assets.

The Benefits of Cryptos

Crypto brings several benefits that are reshaping the financial landscape:

- Financial Freedom: With crypto, users have full control over their funds, allowing them to send and receive payments globally without relying on traditional banks.

- Faster Transactions: Crypto enables near-instant transactions, especially for international payments, which typically take days through traditional banking systems.

- Lower Costs: Crypto transactions, especially for cross-border payments, are often more affordable than using wire transfers or remittance services.

- Increased Security: Transactions on blockchain networks are secure, transparent, and immutable, reducing the risk of fraud or tampering.

- DeFi and Smart Contracts: Crypto platforms like Ethereum enable decentralized finance (DeFi), allowing users to borrow, lend, and trade without intermediaries. Smart contracts automate financial transactions and open up new possibilities for programmable assets.

Risks of Cryptos

While crypto offers many advantages, it also carries risks:

- Volatility: Crypto prices can fluctuate wildly, making it a high-risk investment. Significant gains can be made, but losses can happen just as quickly.

- Regulatory Uncertainty: Governments around the world are still figuring out how to regulate crypto. Changes in regulation can impact its use and legal status.

- Security Threats: While blockchain technology is secure, users need to protect their private keys and wallets. Hacking and phishing attacks remain a threat, and stolen funds are often irrecoverable.

- Lack of Consumer Protection: Unlike traditional financial systems, crypto transactions are not insured or reversible. If something goes wrong, it’s up to the user to resolve the issue.

How to Get Started with Cryptos

Here are the basic steps to get started with cryptos:

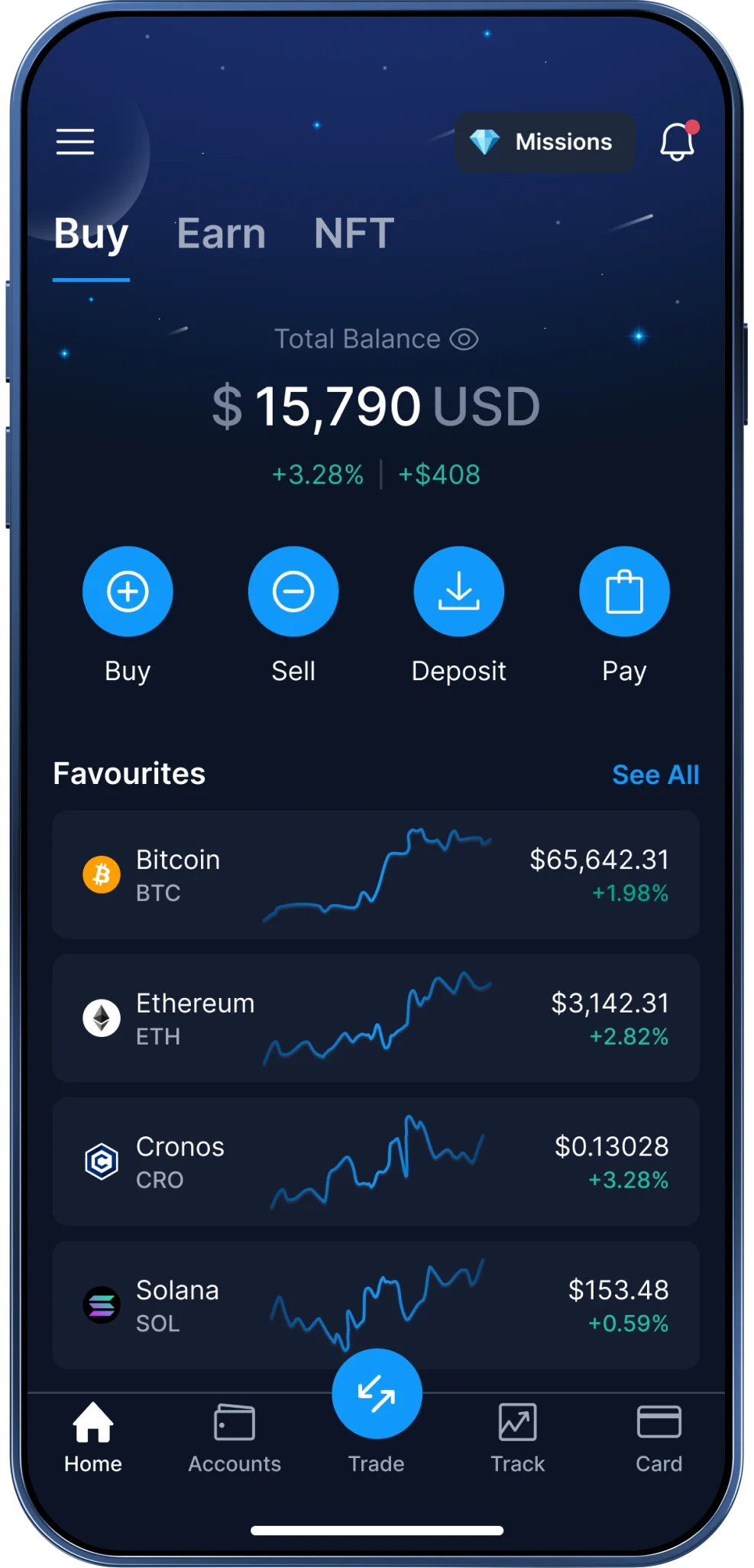

- Choose a Crypto Exchange: To buy crypto, sign up for a trusted exchange like Coinbase, Binance, or Kraken. These platforms allow you to buy, sell, and trade cryptocurrencies using fiat currency or other cryptos.

- Set Up a Wallet: After purchasing crypto, store it in a digital wallet. You can choose between hot wallets (online) and cold wallets (offline hardware devices). Hot wallets offer convenience, while cold wallets provide more security for long-term storage.

- Buy Cryptocurrency: Once your wallet is set up, buy cryptocurrency with fiat currency (USD, EUR, etc.) or trade crypto for other assets on an exchange.

- Secure Your Investment: Use additional security measures, such as two-factor authentication (2FA), to protect your exchange account and wallet.

The Future of Cryptos

Cryptos is rapidly evolving, and its impact will likely grow across various industries. Here are some trends shaping the future of crypto:

- Institutional Investment: Large financial institutions, including PayPal, Visa, and Mastercard, are beginning to adopt and integrate crypto into their services.

- DeFi Expansion: Decentralized finance (DeFi) is one of the fastest-growing areas in crypto. DeFi applications allow users to lend, borrow, and trade assets without intermediaries, reshaping traditional finance.

- Central Bank Digital Currencies (CBDCs): Many governments are exploring their own digital currencies, which could coexist with or compete against decentralized cryptocurrencies.

- Sustainability: As the environmental impact of crypto mining becomes a concern, the industry is moving toward more energy-efficient consensus mechanisms like Proof of Stake (PoS).

Conclusion

Cryptos has introduced a new era of financial freedom, providing decentralized, secure, and accessible alternatives to traditional systems. As adoption grows, crypto will likely play an even larger role in everyday transactions, investments, and innovations like DeFi and smart contracts. However, it’s important to understand the risks involved and invest responsibly.